TRANSPARENT, RELIABLE, TRUSTWORTHY

The strong foundation of our commitment.

Without support, you’re just a kite in a hurricane.

Who we are?

In a twisted world, we provide you with a stable foothold.

Alkyon Capital combines its practical experience, connections and financial lines to optimize financial solutions for football clubs.

We focus on simple, fast and competitive solutions for our clients.

Leverage our expertise and the rich experience of our consultants, and gain valuable insights tailored to elevate and refine your strategic ventures.

We offer personalized services designed to meet each client's unique needs, delivering excellent results with careful attention.

-

Factoring

With factoring, we purchase outstanding receivables on behalf of our clients. This process is completed within just a few days, enabling clients to access their funds promptly and efficiently.

We buy receivables in these areas:

Player transfers

Volume: from €1 million (sometimes less)

Region: worldwide, with preference for European debtors

Occasionally buy non-performing receivables

Broadcasting/TV contracts

Volume: from €1 million

Region: clubs and associations worldwide

Sponsorship contracts

Volume: from €1 million (sometimes less)

Region: worldwide

-

Credit Lines

We work with trusted experts to offer clients safe and reliable credit lines that fit their financial needs.

Depending on the borrower’s creditworthiness and financial profile, these credit lines can be granted on either an unsecured or secured basis, tailored to meet specific requirements.

Types of credit lines available include overdrafts, guarantee credits, Lombard financing, short-and long-term revolving credit facilities, and, finally, stand-by credits.

Volume: flexible credit lines starting from 0.1 million Euros and upwards.

Region: accessible worldwide, catering to a broad international clientele.

-

Commercial Rated Loans

With medium or long-term credit, we help our customers make bigger, safer investments with more confidence.

In close cooperation with our trusted funding partners, we carefully tailor flexible offers while thoroughly evaluating suitable collateral to ensure optimal financing solutions.

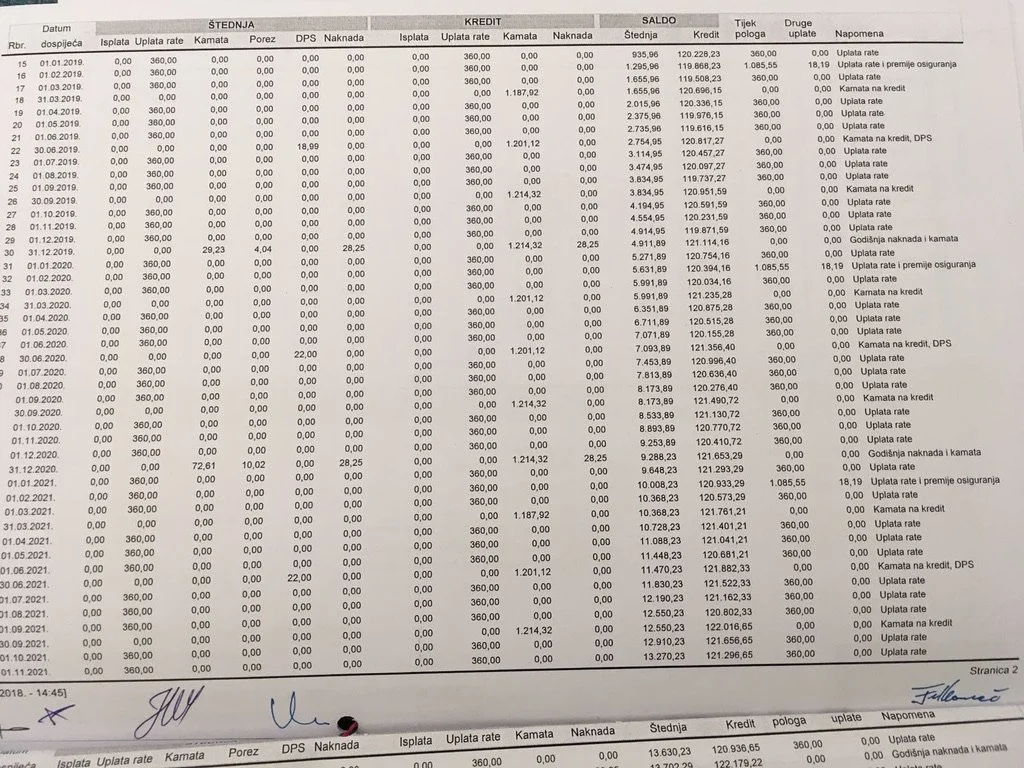

Type of rated loans: annuity based, instalment, redemption loan, bullet and/or fixed loan.

Volume: Loans from € 1,0M+ Euros.

Region: worldwide.

-

Restructuring & Recaps

When capital resources can no longer be made available, “refinancing” often serves as a crucial tool to improve the liquidity situation or alleviate balance sheet strain, thereby increasing solvency and providing much-needed liquidity.

With trusted partners, we assess loan options for clients with cash flow issues, improving finances through smart asset use. Since the pandemic, this has successfully supported teams and leagues.

Volume: from 5.0M+ Euros.

Region: worldwide.

-

Bridge Or Structured Instruments

Description goes here -

Corporate And High Yiels Bonds

Description goes here -

Special Purpose Vehicle

Description goes here -

Consulting

Description goes here

Our partners

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!